Reading notes: Strategy as a portfolio of real options

A valuation approach that appreciates learning and adapting to market changes.

Table of Contents

Discounted-cash-flow valuation doesn't value learning and adapting to market changes, as it assumes following a fixed predefined plan.

Luehrman extends his previous framework in which he introduced valuing the projects as real options (see Investment opportunities as real options), arguing that strategy consists of a series of options.

A gardening metaphor: Options as tomatoes

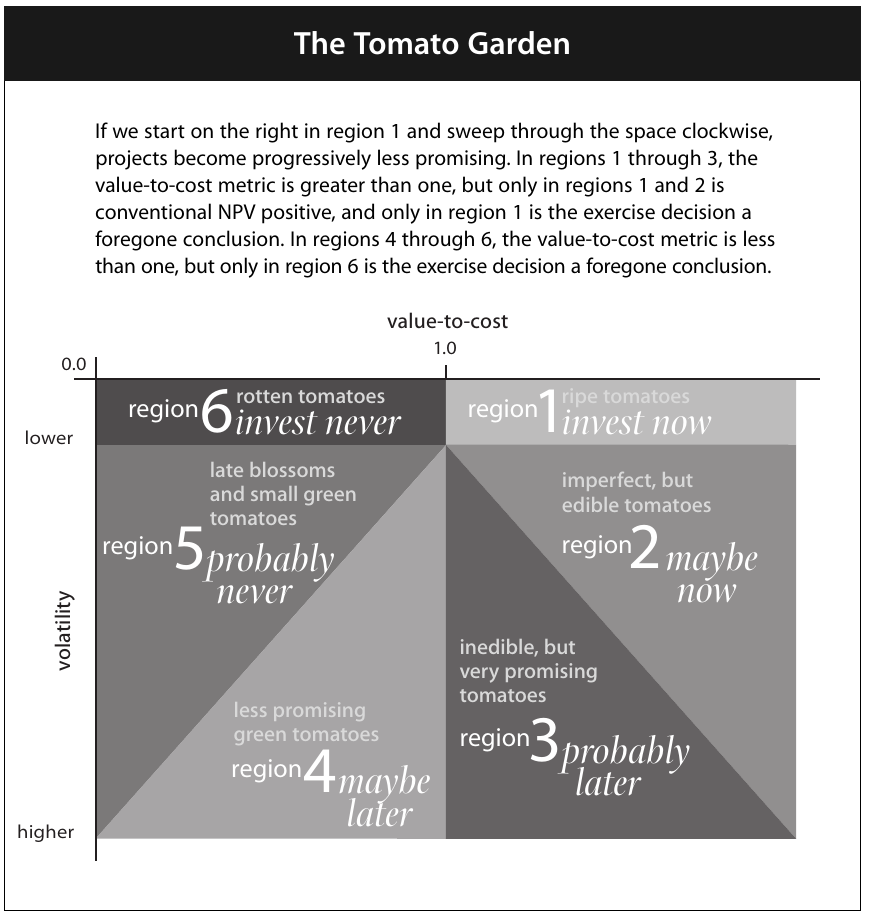

Luehrman introduces tomato garden as his overarching metaphor, where tomatoes represent options, and garden being the portfolio. A good gardener knows when to pick up tomatoes, and how to tend after them in order to maximise garden's yield.

A tour of option space

Luehrman defines the option space with value-to-cost quotient, $NPVq$, and cumulative volatility, $\sigma \sqrt{t}$.* From there, he divides it into six regions, sticking with his tomato metaphor:

| Region | Metaphor | Invest? |

|---|---|---|

| 1 | Ripe tomatoes | Now |

| 2 | Imperfect, but edible tomatoes | Maybe now |

| 3 | Inedible, but very promising tomatoes | Probably later |

| 4 | Less promising green tomatoes | Maybe later |

| 5 | Late blossoms and small green tomatoes | Probably never |

| 6 | Rotten tomatoes | Never |

*For more details on $NPVq$ and $\sigma \sqrt{t}$ read Investment opportunities as real options: Getting started on the numbers.

Top of the space: Now and never

Regions 1 and 6 are straightforward. Cumulative volatility is zero, most likely due to time to make a decision running out. That means that we are basing the investment decision solely on value-to-cost quotient. If it is above 1 then we should invest, otherwise we shouldn't.

Right side of the space: Maybe now and Probably later

Regions 2 and 3 are separated by conventional NPV, where NPV > 0 for former, and NPV < 0 for latter:

- Options in region 2 might be considered for early investment.

- Options in region 3 are promising, and need to be developed further. They shouldn't be invested in early.

Strong reason for early investment is if there is a high likelihood of predictable loss in case of a deferred investment. Unpredictable gains and losses are not a good reason for investing early.

Luehrman lists pending changes in regulations, a predictable loss of market share, or preemption by a competitor as valid examples for early investing.

Left side of the space: Maybe later and Probably never

Regions 4 and 5 have conventional NPV < 0:

- Options in region 4 are more promising because they have higher cumulative volatility, meaning their value-to-cost ratio still has a chance to improve if they are given sufficient time.

- Options in region 5 don't seem very hopeful, but can be kept open until time runs out.

When to harvest

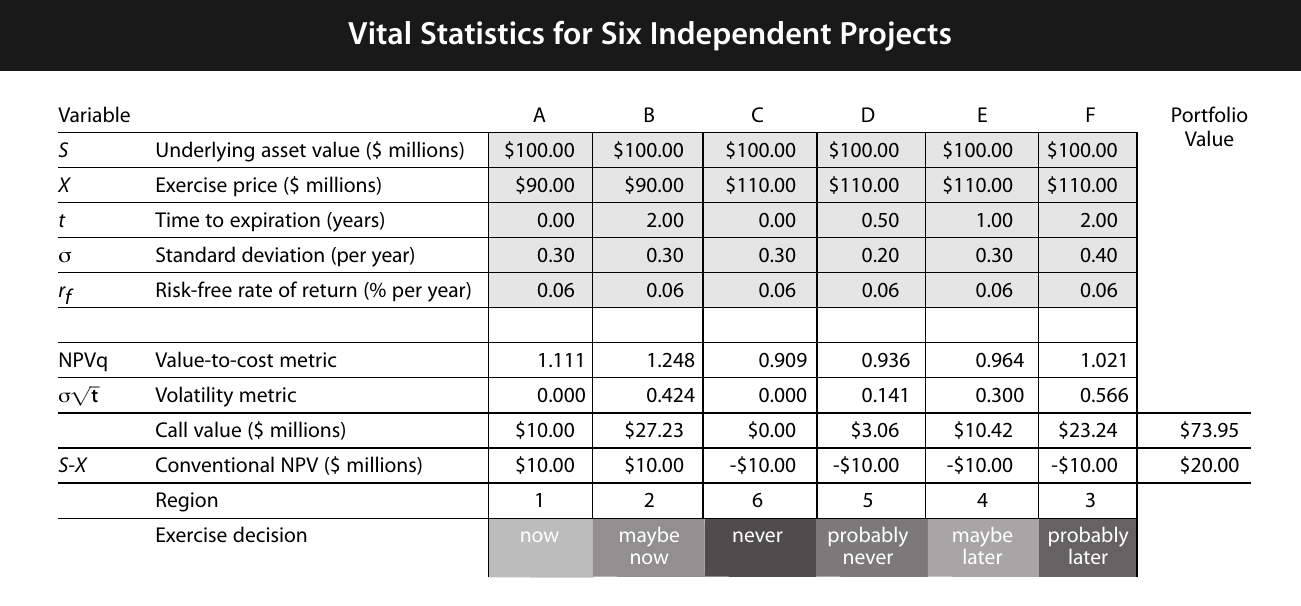

In his example Luehrman analyses a portfolio that consists of six projects:

Traditional DCF analysis suggests that we accept two, and reject four projects, valuing the whole portfolio at \$20 million. Options-based approach suggests we accept one and reject one project, while keep four projects open. It values the portfolio at \$74 million.

A dynamic approach

Left untouched, options tend to lose value because both value-to-cost and volatility metric decrease with passage of time.

Options can be improved by active management. Luehrman argues that managers find it easier to improve value-to-cost metric because it deals with common issues like managing revenues, costs, and capital expenditures

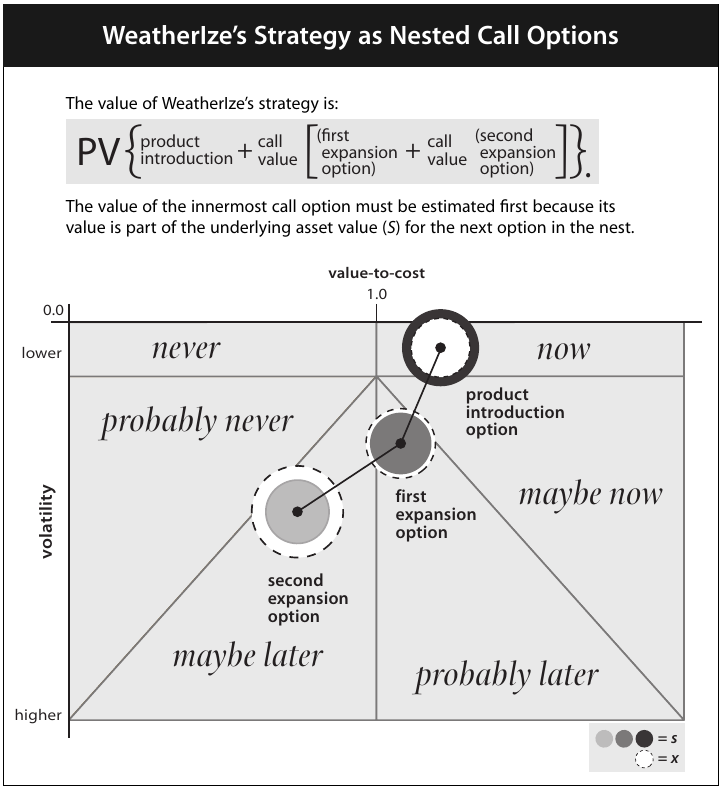

Nested options in a business strategy

Luehrman introduces the concept of nested options, where options are connected. In other words, exercising one option has direct influence on all linked options. Real-options framework allows us to capture the value quantitatively, and the tomato garden allows us to visualise it:

References

Luehrman, T. A. (1998). Strategy as a portfolio of real options. Harvard Business Review, 76, 89–101.

Bruno Unfiltered

Subscribe to get the latest posts delivered right to your inbox. No spam. Only Bruno.