Is investing in innovation worth it?

A stroll through academic thought pieces.

Every morning I take one A6 index card and write down my daily to-dos.

One gray and rainy morning a thought passed through my mind.

What do academics think about investing in innovation?

On any other morning I'd allow this thought to pass. But not that morning. That time I felt masochistic enough to dive into it.

The dive

After skimming through thirty articles, some books, and spending several hours gazing at correlation and significance tables, my curiosity was sated.

Since academics have unparalleled ability to make even the most trivial stuff sound esoteric and exquisite, I've been able to discard half of my reading after checking the abstract against the actual text.

Academics really like tables. I like tables as well. But I don't like tables with 20 rows and 18 columns filled with abbreviations, and footnotes so small I have to zoom in three times.

Anyhow, here are the notes from articles I've found most useful.

Relationship between knowledge sharing, innovation and performance

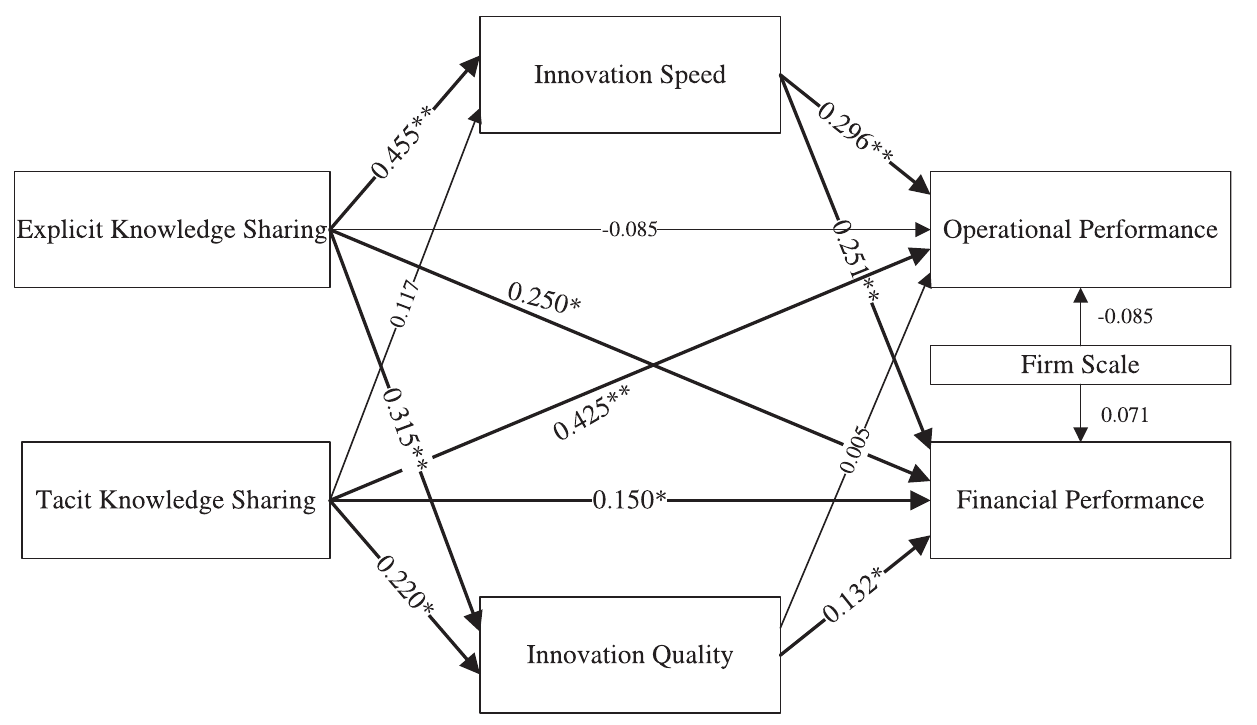

Wang and Wang (2012) attempted to quantify relationship between knowledge sharing, innovation and performance. Their results are based on the data from 89 high technology firms of varying sizes and capital, in Jiangsu Province of China.

What I like in their model is how they've distinguished between speed and quality of innovation, ad operational and financial performance of the firm. Knowledge sharing is split into explicit and tacit, where authors defined former as documented (e.g. reports) and latter as conversational and peer based.

Here is the model and testing results:

Bold lines represent positive and significant association.

Interesting takeaways:

- Innovation speed has more effect on firms performance than innovation quality. (Authors defined quality as Are we innovating better than competition?)

- Documenting knowledge has significant effect on both speed and quality of innovation.

- Peer-based knowledge sharing has direct effect on the firm performance.

- Firm scale isn't as important as we make it to be.

Limitations of their study: survey responses were self-reported, all companies from same geography and culture, so generalisation might not be advisable.

Innovation and its influence on business and product outcomes

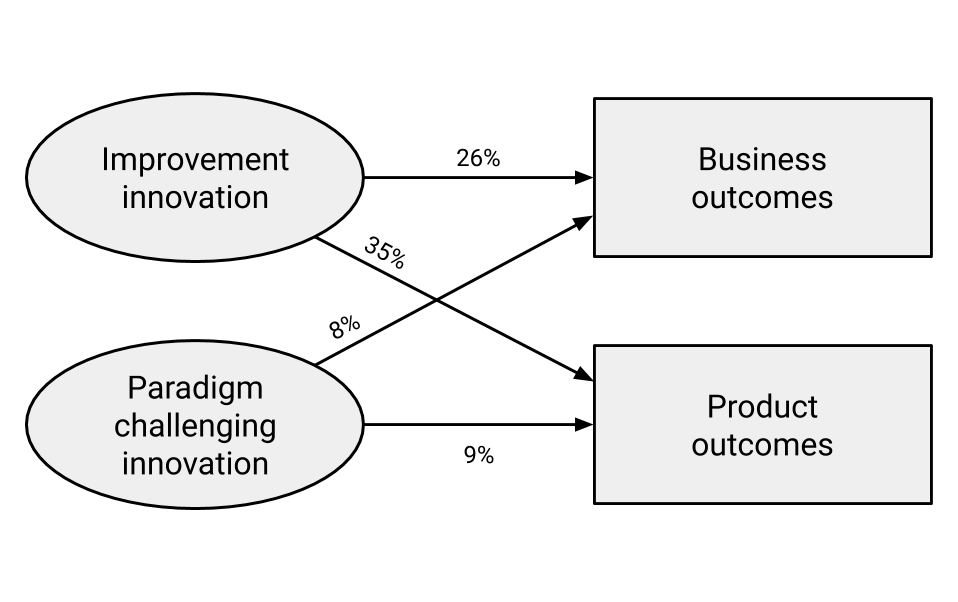

In Creativity unlimited: Thinking inside the box for business innovation, Dahlén shares an interesting figure:

Figure shows the result of a systematic analysis of 350 European, American and Asian brands within every area from cars to computers, cosmetics, clothes, drinks and cleaning products. Over a two-year period, researchers examined how creativity affected the company’s outcomes in the form of sales growth, market share, profit levels and return on investment (ROI). They also measured product outcomes in terms of customer satisfaction with the products, and the perceived quality of the products. The percentages in Figure show the extent to which creativity accounts for a company’s earnings and how much the customers like the product.

My key takeaway from this is that incremental innovation as a precursor to paradigm-challenging innovation, and that firms have a lot to gain by focusing on it. Talking about radical and disruptive is more PR friendly, but more difficult than many realise. Hence, such initiatives get terminated due to lack of financial performance or turn into an innovation theatre.

The strategic fit between innovation strategies and business environment in delivering business performance

Prajogo's paper (2016) investigates relationship between:

- product innovation strategy,

- process innovation strategy,

- environmental dynamism,

- environmental competitiveness, and

- business performance (sales growth, profitability, market share).

Findings are based on data from 207 manufacturing firms in Australia:

- Process innovation has more effect than product innovation in highly competitive markets.

- Product innovation is an effective strategy in highly dynamic markets, i.e. where market demands and needs change regularly.

This study hasn't revealed anything new to me, but perhaps reinforced my view that brining new products and services to the market is a good strategy as long as you can actually meet the needs.

Longitudinal study of the impact of R&D, patents, and product innovation on firm performance

Artz et al. (2010) analyzed a sample of 272 firms in 35 industries over 19 years. Findings that I've found interesting are:

- New product announcement have significant effect on the firm's sales growth and profitability. This effect is short-lived.

- Firms with low levels of investment in R&D can achieve high innovative output if the focus on rapidly responding to changing market demand with new products.

- There is negative relationship between patents and ROA and sales growth.

Another one in the camp of new products are good as long as you can meet the customer demand.

Innovation and firm performance of 3000 Dutch SMEs

In a report financed by the Netherlands Ministry of Economic Affairs, Kemp et al. (2003) interviewed 3000 Dutch SMEs. They've spoken with either general director or the person responsible for R&D and innovation.

They've looked at the relationship between innovation intensity, process, output, and firm performance. Last one was measured by turnover growth, employment growth, profit and productivity:

For only two indicators, significant effects are found, turnover growth and employment growth. Profit and productivity are not significantly influenced by innovative output. The explained variance of all firm-performance indicators is low, leaving a large share to be explained by other aspects. Also here there is a big difference between small and medium-sized firms. For small firms the innovative output has a much bigger impact on the turnover growth than for medium-sized firms. For employment growth we see the opposite effect: for small firms innovative output does not influence the level of employment growth, for medium-sized firms there is a positive effect.

This report is well written and easy to read. At one moment I squinted hard to see all the numbers, but then I remembered it's a PDF I can zoom into.

Capital investment, innovative capacity, and stock returns

You know there's something waiting to ambush you when the paper's appendix is as long as the main text itself. Kumar and Li (2016), after a lot of mathematics and abbreviations, conclude that investing in developing innovation capability has positive influence on expected revenues, future revenues and profitability.

Business model innovation and firm performance

Most of the articles I've read focused on products and processes. Recently, business model innovation has been graining ground, making explicit many different forms of innovation.

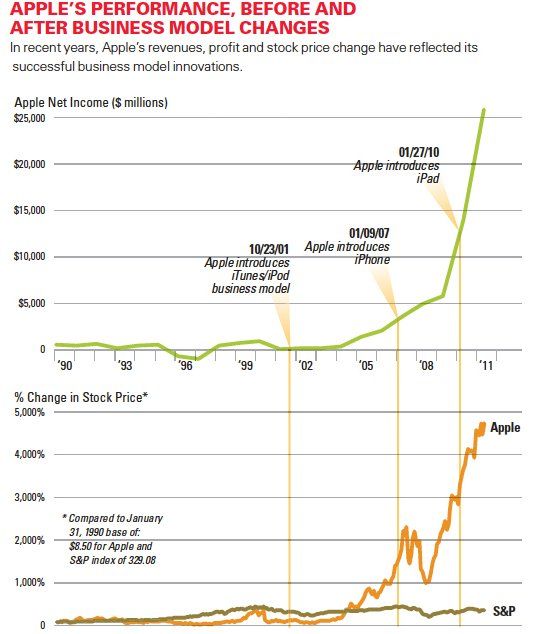

Amit and Zott (2012) use Apple as an example to demonstrate the relationship between firm's performance and business model innovation:

Notice how inflections in the curve are described with product introductions. These products had that much impact on the stock because they were supported by business model innovation as well.

So, is investing in innovation worth it?

Yes, and consider following:

- incremental innovation has more effect than radical innovation,

- performance-wise, speed of innovation matters more than quality of innovation,

- knowledge sharing has positive impact on speed and quality of innovation, and

- introducing new products is a viable strategy for firm's performance as long as you can rapidly develop them and meet customer needs.

The rain isn't falling any more, but it's still gray outside.

References

Amit, R., & Zott, C. (2012). Creating value through business model innovation. MIT Sloan Management Review, 53(3), 41.

Artz, K. W., Norman, P. M., Hatfield, D. E., & Cardinal, L. B. (2010). A Longitudinal Study of the Impact of R&D, Patents, and Product Innovation on Firm Performance. Journal of Product Innovation Management, 27(5), 725–740.

Dahlén, M. (2008). Creativity unlimited: Thinking inside the box for business innovation. John Wiley & Sons.

Kemp, R. G. M., Folkeringa, M., de Jong, J. P. J., & Wubben, E. F. M. (2003). Innovation and firm performance (Research Report No. H200207; p. 67). EIM Business & Policy Research.

Kumar, P., & Li, D. (2016). Capital Investment, Innovative Capacity, and Stock Returns. The Journal of Finance, 71(5), 2059–2094.

Prajogo, D. I. (2016). The strategic fit between innovation strategies and business environment in delivering business performance. International Journal of Production Economics, 171, 241–249.

Wang, Z., & Wang, N. (2012). Knowledge sharing, innovation and firm performance. Expert Systems with Applications, 39(10), 8899–8908.

Bruno Unfiltered

Subscribe to get the latest posts delivered right to your inbox. No spam. Only Bruno.